What Happened?

The Good

Higher education institutions have known for a few years that changes to the FAFSA were on the horizon. The FAFSA Simplification Act, passed by Congress in 2021, changed how federal student aid is awarded.

The law aimed to make the FAFSA form shorter and easier to complete, reducing the number of questions from 118 questions to 36 questions, while also expanding Pell Grant access. With a connection to IRS data, it would also remove the burden on low-income families to prove they are eligible year after year.

The intentions of the FAFSA Simplification Act? Good. As for the execution of implementing those changes? Let’s dig in…

The Bad

In March 2023, the Department of Education announced that the FAFSA, typically available Oct. 1, would be available sometime in December. This was a major red flag for institutions that were already feeling a bit anxious about the change.

Now financial aid offices would need to run a marathon from January to May to package new students and returning students, while also navigating the changes to the student aid index.

But the obstacles didn’t stop there.

When the form was released on December 31, it was riddled with technical glitches. Many students were unable to access the form for several days, and others hit roadblocks. Parents without a social security number, for example, could not start or contribute to a student’s form.

Institutions expected the first batch of student forms by the end of January, which was then delayed until mid-March.

By the time many schools did receive student information, there was another problem—a miscalculation of the Student Aid Index. Some of their financial aid information might be incorrect if schools already packaged students.

Overall, the execution of the FAFSA changes: bad.

The Ugly

The population the FAFSA changes should have helped the most (low-income and first-generation students) were less likely to complete the FAFSA compared to higher income students amid the chaos this year.

As of April 5, there was a 38% decrease in year-over-year FAFSA completions—approximately 720,000 fewer students.

And as of May 17—just six weeks later—that gap had narrowed to a 15.5% decrease in FAFSA completions or about 317,000 students. Still, that’s 317,000 students left behind!

Students and families who struggled with the FAFSA form, and had short windows to compare financial aid packages from institutions, were feeling disenchanted by the entire process, and in some cases questioning the value of a college degree.

It became clear that some institutions would experience a drop in enrollment because of this.

The Better Way

Institutions couldn’t control the changes to the FAFSA or the terrible execution, but those that fared the best were those who controlled what they could. Here are a few of the strategies used by our partners to boost FAFSA files throughout yield season.

- Transparent communication. Institutions sent emails, letters, explainer videos, etc. to students early and often to build trust and help their students (new and returning) navigate the chaos. This continued through yield season to ensure as many students as possible complete their FAFSA.

- Estimate need-based aid. Institutions did their best to estimate how much need-based aid students would receive, and then honored it or stayed as close to it as they could once FAFSA data was received. This allowed students to make earlier comparisons, especially for private schools.

- Increase preparedness. Institutions trained their admissions counselors to answer financial aid questions and communicate with families. As packages went out, emails and letters included information about scheduling 1:1 appointments for students and families to understand their aid. Families want to talk to another human, and those schools that made their people available won big.

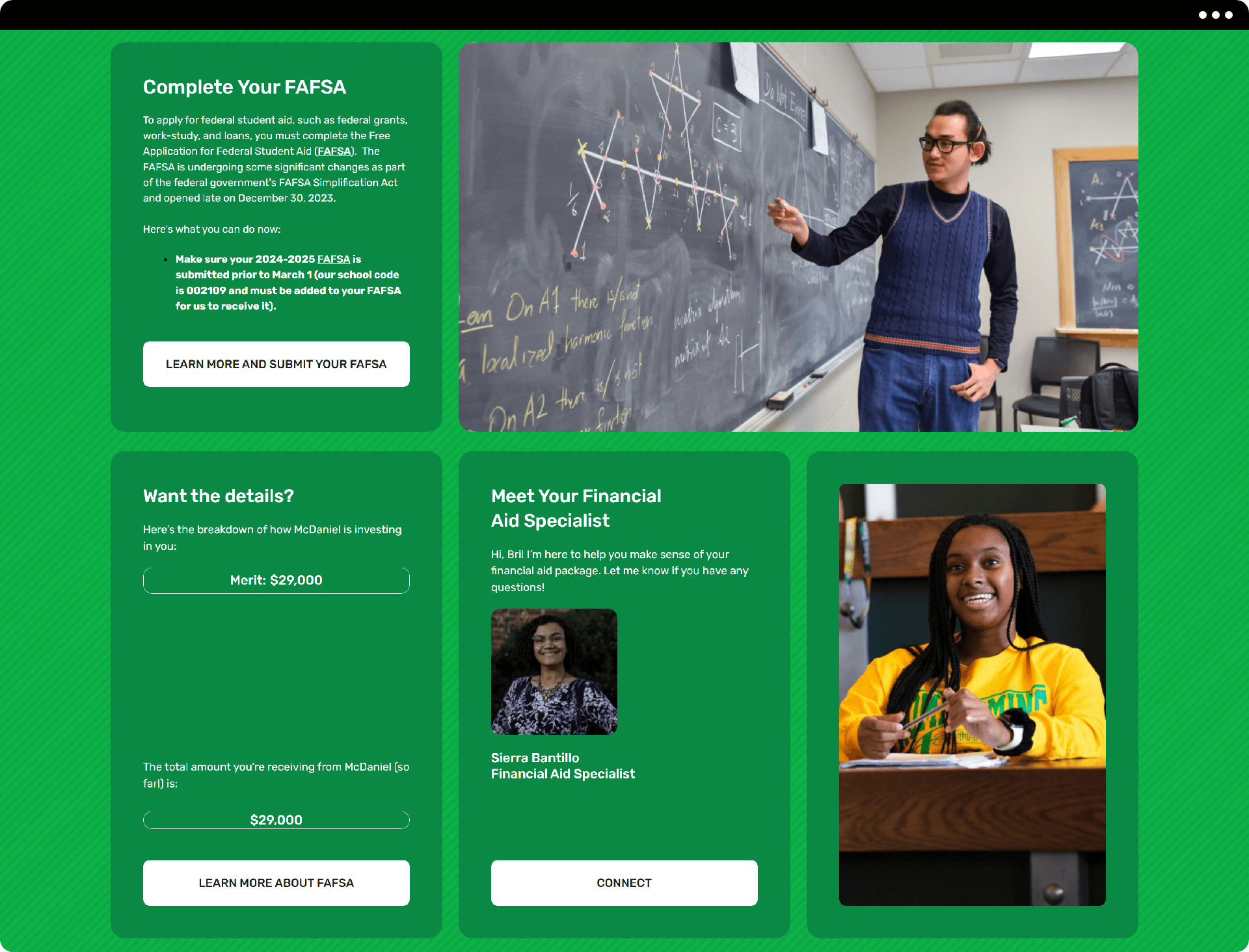

- Commiserate. Institutions channeled FAFSA frustration into opportunities to connect with students. At McDaniel College’s accepted student day, attendees had the chance to throw plates at a wall representing the FAFSA form. Institutions ensured students and families frustrated by the process knew they weren’t alone.

- Extend deadlines. Many institutions recognized that a May 1 enrollment deadline was unrealistic, leaving students and families with mere days to make big decisions. Schools pushed enrollment deadlines to June 1, and added more accepted student events during April and May, allowing students more opportunities to connect and ultimately deposit.

Institutions implementing these strategies saw more FAFSA files and ultimately helped fill their incoming classes. An institution on the West Coast increased FAFSA communication throughout the spring and landed up 75 deposits. A partner in central Pennsylvania said, “We’re the most up we’ve ever been.” A partner in Ohio called this year “an epic comeback story.” In fact, most of our partner institutions—across Illinois, Massachusetts, Pennsylvania, Michigan, Ohio, Missouri, Georgia, Maryland, Kansas, and others—have reached or exceeded their incoming class goals.

Looking Ahead

Hopefully, the FAFSA form and process will be much smoother for the 2025-2026 cycle. But based on this year’s rollout, we won’t hold our breath!

Control what you can, and learn from the challenges of this year.

- Make sure your communications to your incoming student populations clearly outline the FAFSA process. Send one-off communications to students when the form becomes available. Send follow-up communications to students who have applied and not completed their FAFSA.

- Ensure your student application and admit portals call out FAFSA reminders for those who haven’t filed.

- Schedule and advertise more financial aid events, like FAFSA File Nights and information sessions.

- Set in place processes now to get financial aid packages out as early as possible next cycle.

Want to talk FAFSA and enrollment strategy? Set up a time to chat with our Waybetter team.